What is SR&ED?

What is SR&ED? It’s an excellent question, one that has previously been answered by the CRA in great detail. The content on this page is based on the CRA document Overview of the Scientific Research and Experimental Development (SR&ED) Tax Incentive Program (RC4472). This document was produced by the Canada Revenue Agency (CRA) in 2008 and remains one of the best explanations of the program. While it has been archived, we’ve saved a copy of the original here. As some references are no longer accurate (the program was overhauled in 2012), we have used strikethrough to indicate out-of-date text and highlighted updates in green.

Table of Contents

How to navigate: Click on the name of a section or subsection to go directly to that area of the page.

- What is the SR&ED program?

- What is the objective of the SR&ED program?

- How can the SR&ED program benefit my company?

- What businesses are eligible?

- What is SR&ED? (Alternatively, “What is SRED”?)

- What is not “SR&ED”?

- What are the eligibility requirements?

- What expenditures can I claim?

- How do I determine my SR&ED expenditures?

- What are the SR&ED investment tax credit rates?

- How do I make a claim?

- When do I file my claim?

- What happens after I send in my claim?

- What happens during the review process?

- What do the reviewers need from me?

- What supporting documentation do I need to keep?

- What can I do if I have concerns?

- What services are available?

- Where can I obtain more information?

- Who can I contact to get more information?

What is the SR&ED program?

The Scientific Research and Experimental Development (SR&ED) tax incentive program is the largest single source of federal government support designed to encourage research and development (R&D) in Canada.

Each year, the SR&ED program provides over $4 billion in investment tax credits (ITCs) to over 18,000 claimants over $3 billion in tax incentives to over 20,000 claimants. Of these, about 75% are small businesses.

What is the objective of the SR&ED program?

The objective of the SR&ED program is to deliver SR&ED tax incentives in a timely, consistent and predictable manner while encouraging businesses to prepare their claims in compliance with tax laws, policies, and procedures.

The Canada Revenue Agency (CRA) is continuously seeking new ways to improve and simplify its service delivery. The program commitments are to:

- Ensure that businesses are aware of the program and can access it as easily as possible; and,

- Administer the program with fiscal integrity by applying the legislation correctly, consistently and fairly, and ensuring that claimants receive the full amount to which they are entitled.

How can the SR&ED program benefit my company?

The SR&ED program can provide financial incentives by helping to:

- Fund the scientific and technological advances that keep your company competitive, and,

- Better position your company for future SR&ED projects.

- You may be able to deduct SR&ED expenditures to reduce your tax liability in the current year or carry these expenditures forward indefinitely to reduce your tax liability in future years.

- You may be eligible to receive benefits in the form of a refundable investment tax credit (ITC), a reduction of taxes payable, or both.

- Unused ITCs may be carried back three years or carried forward 20 years if they were earned in tax years ending after 1997 (carried forward ten years if they were earned in tax years ending before 1998).

How can the SR&ED program benefit my company?

The SR&ED program can provide financial incentives by helping to:

- Fund the scientific and technological advances that keep your company competitive, and,

- Better position your company for future SR&ED projects.

- You may be able to deduct SR&ED expenditures to reduce your tax liability in the current year or carry these expenditures forward indefinitely to reduce your tax liability in future years.

- You may be eligible to receive benefits in the form of a refundable investment tax credit (ITC), a reduction of taxes payable, or both.

- Unused ITCs may be carried back three years or carried forward 20 years if they were earned in tax years ending after 1997 (carried forward ten years if they were earned in tax years ending before 1998).

What businesses are eligible?

The SR&ED program is available to any business operating and carrying out R&D in Canada. Certain expenditures for SR&ED performed outside Canada are also permitted.

Any business that is involved in basic or applied research, or in advancing technology in order to improve or develop new materials, devices, products or processes may be eligible under the SR&ED program.

The businesses that are eligible under the SR&ED program fall into three groups:

- Canadian-controlled private corporations;

- Other corporations; and,

- Proprietorships (individuals), partnerships and trusts.

1. Canadian-controlled private corporations (CCPCs)

If you are a CCPC, you may receive a refundable investment tax credit (ITC) on your qualified SR&ED expenditures. You must first apply these ITCs against taxes payable in the year of the claim. The balance may be refunded.

The rate of refundability is based on your taxable income and taxable capital in the previous year and an expenditure limit. The table in the section “What are the SR&ED Investment Tax Credit Rates” on page 9 provides further information.

2. Other corporations

For other corporations, the ITC is 20% of qualified current and capital SR&ED expenditures. The ITC may be applied to taxes payable and is not refundable.

3. Proprietorships, partnerships and trusts

For proprietorships, partnerships and trusts, the ITC rate is 20% of qualified current and capital SR&ED expenditures. After applying the ITCs against taxes payable, you may receive a cash refund on 40% of the balance of the ITCs earned in the tax year.

What is SR&ED? (Alternatively, “What is SRED”?)

The definition of “scientific research and experimental development” given in subsection 248(1) of the Income Tax Act can be summarized as:

…systematic investigation or search carried out in a field of science or technology by means of experiment or analysis . . . to advance scientific knowledge or to achieve technological advancement.

The work must fall into one of the following categories:

- Experimental development – This is the work done to achieve technological advancement for the purpose of creating new, or improving existing, materials, devices, products or processes.

- Applied research – This is work done to advance scientific knowledge with a specific practical application in view.

- Basic research – This is work done to advance scientific knowledge without a specific practical application in view.

SR&ED can also include other work that is directly in support of the experimental development, applied research or basic research. This support work includes only the following eight specific types:

- Engineering

- Design

- Operations research

- Mathematical analysis

- Computer programming

- Data collection

- Testing

- Psychological research

The support work to be claimed must correspond to the needs of the experimental development, applied research or basic research performed.

What is not “SR&ED”?

Certain work is not eligible for benefits under the SR&ED program, including:

- Market research or sales promotion;

- Quality control or routine testing of materials, devices, products or processes;

- Research in social sciences or the humanities;

- Prospecting, exploring or drilling for, or producing minerals, petroleum or natural gas;

- Commercial production of a new or improved material, device or product, or the commercial use of a new or improved process;

- Style changes; and,

- Routine data collection.

What are the eligibility requirements?

For any R&D work to be eligible for SR&ED:

The work must be a systematic investigation or search carried out by means of experiment or analysis;

■ This would include identifying the obstacle, formulating an objective, developing a plan of action including the method of experimentation or analysis and testing the hypothesis.

The work must be carried out in a field of science or technology that is not excluded by the legislated definition of SR&ED;

■ Excluded work is described under the heading “What is not SR&ED?”

AND

The work must be undertaken either:

■ For the purpose of achieving technological advancement. The work must attempt to increase the technology base or level from where it was at the beginning of the systematic investigation or search. The technology base or level includes all the technological resources within the business and all the knowledge on the technology that is reasonably available in the public domain.

OR

■ For advancing scientific knowledge. A systematic investigation or search must be carried out with the aim of generating new scientific information or understanding of scientific relations.

Note

A project does not have to succeed to qualify for the SR&ED tax credit. To help you determine if your R&D work meets SR&ED requirements, please try our on-line Eligibility Self-Assessment Tool at www.cra.gc.ca/sred/assessment read [the CRA’s] Eligibility of Work for SR&ED Investment Tax Credits Policy.

For more information on determining the eligibility of your work, please refer toInformation Circular number 86-4R3, Scientific Research and Experimental Development, which is available on the CRA’s website at www.cra.gc.ca/sred under the heading “SR&ED Forms and publications” or by contact your local tax services office.

What expenditures can I claim?

You may claim many of the expenditures incurred for SR&ED during your fiscal year. These expenditures may include:

- Salaries and wages*;

- Materials;

- SR&ED contracts;

- Lease costs of equipment;

- Overhead;

- Third-party payments; and

Capital expenditures.

Note

Certain expenditures for SR&ED performed outside of Canada are now permitted.

How do I determine my SR&ED expenditures?

In determining your SR&ED expenditures, you must choose one of the following two methods:

1. Traditional Method

The traditional method involves claiming all of the SR&ED expenditures you incurred during the year. You must specifically identify your overhead costs.

2. Proxy Method

The proxy method involves calculating a substitute amount for overhead expenditures using a formula, rather than specifically identifying and allocating these expenditures as you would with the traditional method.

For more information, please refer to the T4088 Guide to Form T661, which is available on the CRA’s website at www.cra.gc.ca/sred under the heading “SR&ED Forms and publications” or by contacting your local tax services office [the CRA’s] Traditional and Proxy Methods Policy.

What are the SR&ED investment tax credit rates?

The investment tax credit (ITC) rates and the percentage that you can have refunded or credited vary according to the way your business is structured. The following table outlines the ITCs and the refundable rates that apply to qualified SR&ED expenditures. Most businesses are Canadian-controlled private corporations (CCPCs) with a taxable income of less than $400,000.

| Category | SR&ED expenditures |

ITC rate | Refundable portion of ITC earned on | Non-Refundable portion of ITC earned on | ||

|---|---|---|---|---|---|---|

| Current expenditures | Capital expenditures | Current expenditures | Capital expenditures | |||

| Canadian- controlled private corporations (CCPCs) | Up to your calculated Expenditure Limit* | 35% | 100% |

N/A | ||

| In excess of your calculated Expenditure Limit* |

15% |

40% | 60% | |||

| Other corporations | 15% |

N/A | N/A | 100% | ||

| Proprietorships, partners of a partnership and trusts |

15% |

40% | 60% | |||

| * The expenditure limit ($3 million maximum) is based on the previous year’s taxable income and previous year’s taxable capital. The limit is reduced when taxable income is greater than $400,000 or taxable capital is greater than $10 million. The maximum expenditure limit is $2 million for tax years ending prior to February 26, 2008. | ||||||

| CRA information current at: December 18 2014 1 | ||||||

How do I make a claim?

To make an SR&ED claim you must file an income tax return along with the following prescribed forms:

- Form T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim; and one of the following two forms:

- Form T2SCH31, Investment Tax Credit – Corporations, or,

- Form T2038 (IND), Investment Tax Credits (Individuals).

For more information on making an SR&ED claim, please see the T4088, Guide to Form T661; it is available on the CRA’s website at www.cra.gc.ca/sred under the heading “SR&ED Forms and publications” or by contacting your local tax services office.

When do I file my claim?

To apply for SR&ED tax incentives, you must file the applicable prescribed forms by your reporting deadline.

The reporting deadline for corporations is 18 months (individuals have 17.5 months) from the end of the tax year in which you incurred the expenditures.

If you do not report an expenditure or project on the prescribed forms by the reporting deadline, you will not be able to include the amounts in your pool of deductible SR&ED expenditures to be used to reduce your income, and you will not be able to earn an investment tax credit (ITC) on these expenditures.

For more information on the reporting deadline, please refer to Application Policy SR&ED 2004-02, Filing Requirements for Claiming SR&ED Carried Out in Canada, which is available on the CRA’s website at www.cra.gc.ca/sred under the heading “SR&ED Forms and publications” or by contacting your local tax services office[the CRA’s] SR&ED Filing Requirements Policy.

What happens after I send in my claim?

(Reminder: the text that follows comes directly from the CRA)

When you send in your claim, [the CRA] will determine if it can be processed as filed without further review. If we [the CRA] can process your claim as filed, we [the CRA] will reduce your taxes payable or, if applicable, issue a cheque to you. If [the CRA] cannot process your claim as filed, [the CRA] may contact you to request more information or to discuss the review of your claim.

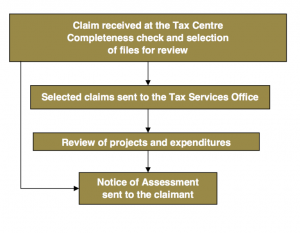

The following chart illustrates how we [the CRA] process SR&ED claims:

If you qualify for a refund, your claim can usually be processed within 120 days after the CRA receives it. A claim could be processed as filed or may require further review. The following chart illustrates [the CRA’s] service standards and goals for processing your claim:

| Type of Claim | Number of Days to Process | CRA Success Rate |

|---|---|---|

| All claims accepted as filed | 60 Days | 90% |

| Refundable claims selected for review/audit | 180 Days | 90% |

| All claims | 90% | |

| CRA updated service standards: April 1 2018 1 | ||

Note

The above service standards apply in those situations where a complete claim has been filed and you have responded to any CRA requests for additional information.

What happens during the review process?

Businesses claiming the SR&ED credit are subject to technical and financial reviews by the CRA to ensure that all eligibility and compliance requirements, as set out in the Income Tax Act, are met.

If [the CRA] cannot process your SR&ED claim as filed, [the CRA] may contact or visit you to review information relating to your claim.

The CRA’s technical and financial review staff work as a team to ensure you get the SR&ED credits to which you are entitled.

The technical reviewer evaluates the work to determine whether it meets the SR&ED eligibility criteria. The financial reviewer looks at the costs associated with your projects to ensure they are eligible SR&ED expenditures. These reviews may involve a site visit to review your documentation, talk to your technical staff who were involved in the SR&ED work, and talk to your financial staff who understand the expenditures being claimed.

All information provided to the CRA technical and financial review staff is held in the strictest confidence. Legislative provisions and stringent rules protect the confidentiality of all claimants’ records.

What do the reviewers need from me?

To expedite your claim and deliver your tax credits in a timely manner, it helps if you:

- Identify a technical contact person in your company who was involved in the SR&ED work;

- Identify a financial contact person in your company who understands the expenditures being claimed;

- Contact the CRA’s technical and financial reviewers if you need to clarify information requested;

- Maintain the technical and financial documents needed to substantiate the claim and make them available if requested; and,

- Respond in a timely manner to CRA requests for more information.

For detailed information on the review process, please see the Guide to Conducting a Scientific Research and Experimental Development Review, which is available on the CRA’s website at www.cra.gc.ca/sred under the heading “SR&ED Forms and publications” or by contacting your local tax services officethe CRA’s The SR&ED Technical Review: A Guide for Claimants.

What supporting documentation do I need to keep?

In order to support your SR&ED claim, it is important to maintain evidence that substantiates the SR&ED work performed and expenditures incurred. If your SR&ED claim is selected for review, you will be asked during the review process to provide this evidence. Generally, the best evidence is that which was generated as the SR&ED was being carried out. Examples of technical and financial supporting evidence that could be kept are:

- Project planning documents

- Documents on the design of experiments

- Experimentation plan

- Design documents and technical drawings

- Project records, laboratory notebooks

- Design, system architecture and source code (software development)

- Records of trial runs

- Project progress reports

- Minutes of project meetings

- Test protocols, data, results, analysis and conclusions

- Final project report or professional publications

- Photographs, videos

- Prototypes, samples

- Scrap, scrap records

- Contracts, lease agreements

- Records of resources allocated to the project, time sheets, activity records, payroll records

- Purchase invoices and proof of payment

- Accounting records

Note

This list is not comprehensive; you should keep any documentation that you feel will support your claim.

What can I do if I have concerns?

If you have concerns during the review process or once the claim has been processed, refer to Application Policy Number SR&ED 2000-02R, Guidelines for Resolving Claimants’ SR&ED Concerns for information on what you can do. These guidelines are available on the CRA’s website at www.cra.gc.ca/sred under the section “SR&ED Forms and publications” or by contacting your local tax services office [the CRA’s] Guidelines for Resolving Claimants’ SR&ED Concerns.

In addition, the Taxpayer Bill of Rights builds upon the CRA’s corporate values of professionalism, respect, integrity and cooperation. It describes the treatment you are entitled to when dealing with the CRA. You can expect that the CRA will serve you with high standards of accuracy, professionalism, courtesy and fairness.

The Taxpayer Bill of Rights also includes the CRA Commitment to Small Business, a fivefour-part statement through which the CRA undertakes to support the competitiveness of the Canadian business community by ensuring that interactions with the CRA are as effective and efficient as possible. These commitments complement the Government of Canada‘s pledge to create a competitive and dynamic business environment in which Canadian businesses will thrive.

What services are available?

The SR&ED program offers several free services that can help you take full advantage of the benefits offered. These services include:

First-Time Claimant Service;First-Time Claimant Advisory Service (FTCAS);Preclaim Project Review (PCPR) Service; Pre-Claim Consultation and Pre-Claim Review;Account Executive (AE) Service; and,- Public Information and Industry-Specific Seminars.

First-Time Claimant Service

If you are a new or potential claimant with questions about our program, our First-Time Claimant Service can help you. This free service helps put your business in touch with SR&ED staff who will:

work closely with you to answer your questions;provide you with information, tools and the help you may need to complete your first SR&ED claim; andpossibly visit your business to explain theprogrambenefits and requirements in more detail.

First-Time Claimant Advisory Service (FTCAS)

The first-time claimant advisory service (FTCAS) is a free in-person service that provides first-time scientific research and experimental development (SR&ED) claimants with an opportunity to meet with local Canada Revenue Agency (CRA) SR&ED staff, at their place of business, to gain a better understanding of the SR&ED Program. During these visits the SR&ED reviewers will provide businesses with advice on:

- How to identify potential eligible work in the context of their business;

- How to identify allowable expenditures;

- The types of documentation and other evidence that could support a claim; and,

- How to complete and file their future SR&ED claims.

The main focus of the FTCAS is to educate claimants in terms of eligibility and documentation requirements and increase predictability in subsequent claims. The service is mandatory for all selected claimants contacted by the CRA. The FTCAS will ensure that first-time claimants have access to all of the information they need to facilitate filing their SR&ED tax incentive claim. If you are a first-time SR&ED claimant selected to receive the FTCAS, you will be notified by letter from a local CRA office. You will then be contacted by a CRA official who will arrange a convenient time for the visit. The visit will take no more than half a day.

During this visit, the CRA officials will:

- Conduct an educational session tailored to your business, which will give you information about the SR&ED Program; and

- Discuss your current project(s) and SR&ED work to better understand your business and the type of work and expenditures claimed.

After the visit, you will receive a report outlining what was discussed during the visit and recommendations on improving future claims, if any. Should a refund be expected as a result of filing a claim, it will be processed after the site visit.

It is important to note that the FTCAS is not a review or an audit and the CRA staff will not make any determination of the eligibility of work or expenditures claimed. This service is provided to first-time claimants to ensure you have all the information necessary to successfully file your next SR&ED claim.

If you have filed your first SR&ED claim and you have received a letter indicating that it has been accepted as filed without a review, and you wish to obtain more information about FTCAS, please contact your local CRA tax services office.

If you wish to obtain assistance before filing your claim, another service such as the Pre-Claim Consultation may be more appropriate for you.

Preclaim Project Review Service (PCPR)

The Preclaim Project Review (PCPR) Service is a free advisory service designed to help businesses in planning and investment decisions by:

identifying which of your company’s R&D projects and work may qualify for SR&ED tax incentives;providing a preliminary opinion on the eligibility of SR&ED projects without having to generate extensive paperwork, potentially reducing the time and cost of claim preparation;helping you understand what supporting documentation should be kept; andestablishing open communication and building a stronger working relationship between you and the CRA.The PCPR Service is available before SR&ED tax incentives are claimed and, ideally, early in the R&D process or even before the work is undertaken. This provides greater up-front certainty about the eligibility of R&D work for SR&ED tax incentives. Note The PCPR Service is neither anadvanced income tax ruling nor a pre-approval of an SR&ED claim. A final determination on any SR&ED claim must be based on the actual work done and can only be made after the claim is filed.

Pre-Claim Consultation

A pre-claim consultation will tell you if there is scientific research and experimental development (SR&ED) work in any of your projects before you send an SR&ED claim.

For a pre-claim consultation, you must meet the basic requirements for claiming SR&ED tax incentives, and the projects for which you are requesting a consultation must meet the following requirements:

- Be completed or in progress

- Were not already reviewed and given an eligibility determination

- Do not involve an issue that is under notice of objection or in litigation

In addition, the date of your request for a consultation must be no later than four months after the end of the tax year in which you did your work.

Based on the information you provide for the consultation, SR&ED reviewers will:

- Identify the research and development work that qualifies as SR&ED

- Provide advice on the supporting documents you need to keep

- Answer your questions, and offer advice and recommendations

- Provide a decision in a written report, which will identify the work that qualifies for SR&ED tax incentives. The decision will correspond to Step 1 of the Eligibility of Work for SR&ED Investment Tax Credit Policy. The report will not include decisions on the extent of eligible work or the allowable expenditures.

To ask for a pre-claim consultation, you have to complete and send an online pre-claim consultation request form. After you send your completed form, a Canada Revenue Agency (CRA) officer will call you to ask for more information to help the CRA decide if you qualify for a consultation.

In your pre-claim consultation request and during your conversation with the officer, give the same contact and business information. Also, have your business and project information on hand to respond to the officer’s questions.

If you have questions about the Pre-Claim Consultation, get in touch with your local SR&ED contact.

Pre-Claim Review

What are the benefits of the Pre-Claim Review?

The Pre-Claim Review will give you the certainty that your claim will be accepted as filed when it is received by the CRA. You will get a determination on the eligibility of your R&D work, and how much of your work and associated expenditures qualify for the SR&ED tax incentives before submitting your claim.

The review of an SR&ED claim is conducted after the CRA has received a complete claim, which can be up to 18 months after the fiscal year end. This may create a significant delay between the performance of SR&ED work and the CRA’s review of the work. Because of this, one of the biggest challenges for claimants is to demonstrate how the work that is claimed is SR&ED. By participating in the Pre-Claim Review pilot, you allow the CRA to conduct a review when the work is taking place, while information and people are more readily available. This will make it easier to establish the scientific or technological knowledge base in a specific business context, and to evaluate whether the work performed is SR&ED.

Who can participate in the Pre-Claim Review?

You must meet the following criteria to participate in the Pre-Claim Review:

- Your business must be incorporated in Canada.

- SR&ED work underway must not be linked to a formal objection or litigation.

- You must not have more than one prior SR&ED claim under review at any point in the current year.

- You must have previously participated in a Pre-Claim Consultation, a First-Time Claimant Advisory Service, or an SR&ED review.

- You will not be claiming more than 20 projects for the current tax year.

- You must provide a Self-Assessment Learning Tool (SALT) report (Step 1 and Step 2) for each project that you plan to claim for the current year.

- You must be willing to participate in periodic review meetings with CRA reviewers.

How can you request a Pre-Claim Review?

If you meet all of the above conditions and want to take advantage of the Pre-Claim Review, you must complete and submit the Request for a Pre-Claim Review form.

Account Executive (AE) Service

The Account Executive (AE) Service is an optional service that assigns your business a designated contact person – an account executive – from the SR&ED program. This free service is generally accessible after a business has already filed its first claim and has had an SR&ED review.

The account executive will provide personal, up-to-date, consistent service by:

being available to answer your questions and deliver advice on the program;working with your company to facilitate your participation in the SR&ED program;being your point of contact for the SR&ED program;giving you a better understanding of the SR&ED program and of the types ofR&D that qualify for SR&ED tax incentives;providing consistency and continuity in service through regular communications throughout the SR&ED process; andproviding advice on preparing and submitting your claim, the type of information that is required to support your claim, as well as the review process (CRA staff members cannot participate in preparing your claim).To find out more about our First-Time Claimant,Pre-ClaimProject Review (PCPR) and Account Executive (AE) services, contact your local CRA tax services office listed on our Web site at www.cra.gc.ca/sredunder the section “SR&ED contacts”.

Public Information and Industry-Specific Seminars

The SR&ED program offers, across the country, free public general information seminars as well as seminars on SR&ED issues specific to a sector or industry. Public general information seminars provide a general overview of the SR&ED program, covering the following: eligibility criteria, qualifying expenditures, how to prepare and file an SR&ED claim and supporting documentation. These seminars are intended for claimants who are new to the program or are planning on filing a claim, and are suitable for an audience of both technical and financial staff.

Seminars on SR&ED issues specific to a sector or industry are specialized workshops for SR&ED stakeholders involved in a specific sector or industry and include presentations, a panel discussion and a case study or examples. The focus is on issues affecting SR&ED claims in a specific sector or industry. These workshops are intended for an audience familiar with the SR&ED program. It is recommended that you first attend an SR&ED public general information seminar.

To view the current seminars in your area please visit the CRA’s at www.cra.gc.ca/sred under the section “Services we offer” or contact your local tax services office page on SR&ED in-person information seminars.

Where can I obtain more information?

Who can I contact to get more information?

| Co-ordinating tax services offices |

Telephone |

|---|---|

| Nova Scotia | 1-866-433-5986 or 902-426-2386 |

| Québec | 1-866-204-0101 extension 648-7151 or 418-648-7151 |

| Montréal | 514-496-1317 |

| Laval | 1-888-784-8709 or 514-338-4198 |

| Toronto-Centre | 416-973-1717 |

| Toronto-West (Mississauga) | 905-566-6010 |

| Hamilton | 905-572-2650 |

| Calgary | 403-691-5890 |

| Vancouver | 1-866-317-0473 |

| Toll free | 1-800-959-5525 |