SR&ED In Federal Budgets (Summary)

The federal budget is where the Canadian government outlines its goals and its challenges; where it introduces expensive new initiatives and jettisons old ones; where it decides to spend–or to cut back. Naturally, the government’s stance on technological innovation plays a prominent role in each year’s budget. We’ve compiled budget documents from 1995 to the present along with summaries, quotations, and context.

- Part 1: Strong Support for Industrial Research and Development (1995 – 2001)

- Part 2: Recovering from the Dot-com bubble (2002-2007)

- Part 3: Economic Dip, Nortel, and the NDP Election Sweep (2008-2011)

- Part 4: Reducing costs, overhauling SR&ED (2012-2015)

- Part 5: New Government, New Innovation Agenda (2016-present)

- What is the impact?

- What Does This Mean?

Part 1: Strong Support for Industrial Research and Development (1995 – 2001)

The 1995 – 2001 period saw federal budgets that strongly supported greater research initiatives, including: skills development, research infrastructure enhancement, and emphasizing the role of the Internet in innovation.

1995 Federal Budget

Liberal majority under Prime Minister Jean Chrétien

The Liberal Party’s 1995 federal budget aimed to concentrate on strategic actions that would foster “innovation, rapid commercialization and value-added production.” The Party pointed to the Medical Research Council as an example of a federally-supported body that formed a partnership within the academic science community in order to create successfully marketed products and support job creation.

Despite pushing for continued progress, the Party also recognized the influence of popular opinion:

“Constant renewal is what this country is all about. Indeed, it is the essential ingredient of a dynamic federalism. The inter-play between the federal government and the provinces has led to remarkable innovation and experimentation. But, as we act to reform government and restore responsibility to our finances, there are those who would argue that this country, this federation, cannot change that Canada is about the status quo. 1

1996 Federal Budget

Liberal majority under Prime Minister Jean Chrétien

The Liberal Party’s 1996 federal budget called for increased investment in Canadian technology and innovation to the tune of a $270 million reallocation from budget savings. In addition, the budget outlined the creation, expansion of, and/or increased support of the following:

- Technology Partnerships Canada (no longer in existence): Fund to grow from ~$150 million to ~$250 million to “encourage partnership and risk-sharing with the private sector and to leverage investment in the development and commercialization of high technology products and processes.”2

- Business Development Bank: “New equity capital of $50 million will be injected into the Business Development Bank to increase its lending efforts in strategic growth sectors, such as new technology.”3

- SchoolNet Program: Every Canadian school and library to be connected to the Internet by 1998, including those in rural communities.

- Information highway: “Ministers of Industry and Canadian Heritage will be introducing policies and reforms to facilitate greater reliance on the marketplace while respecting the commitment to affordable access and to a Canadian presence on the information highway.”4

1996 Budget Plan1996 Budget in Brief

1996 Budget Speech

1997 Federal Budget

Liberal majority under Prime Minister Jean Chrétien

Repeating the 1996 emphasis on investment in Canadian innovation, the Liberal Party announced the establishment of the Canadian Foundation for Innovation (CFI). The Party promised the CFI an $800 million contribution to support research infrastructure in the areas of health, the environment, as well as science and engineering. This contribution was to be utilized by universities, colleges and hospitals. 5

1997 Budget Plan1997 Budget in Brief1997 Budget Speech

1998 Federal Budget

Liberal majority under Prime Minister Jean Chrétien

Much of the 1998 federal budget focused on the Canadian Opportunities Strategy, which had only a small mention of support for the innovative research infrastructures mentioned in the previous year’s budget:

“Effective in 1998-99, the government will increase financial support to the three granting councils — the Natural Sciences and Engineering Research Council, the Medical Research Council and the Social Sciences and Humanities Research Council — to provide research grants, scholarships and fellowships for advanced research and graduate students.6

1999 Federal Budget

Liberal majority under Prime Minister Jean Chrétien

With the 21st century looming, Finance Minister Martin stressed the value of access to education granted by the Canadian Opportunities Strategy, directly equating education with innovation:

“Innovation and knowledge are two sides of the same coin–the true hard currency of the future, the sources of sustained growth.7

1999 Budget Plan1999 Budget in Brief1999 Budget Speech

2000 Federal Budget

Liberal majority under Prime Minister Jean Chrétien

The 2000 federal budget proposed innovative initiatives, to be put in place between 1999 – 2003, totalling $4.1 billion to:

- Promote leading-edge research and innovation in universities, research hospitals and the private sector;

- Develop new environmental technologies and improve environmental practices; and

- Strengthen federal, provincial and municipal infrastructure.8

In addition, the budget stressed the innovative potential in Atlantic Canada’s technological industries while also restating the importance of supporting research and the growth of small and medium-sized enterprises (SMEs).9

2000 Budget Plan

2000 Budget in Brief

2000 Budget Speech

2001 Federal Budget

Liberal majority under Prime Minister Jean Chrétien

The total estimated government expenditures on science and technology were $7.4 billion in 2001 – 2002, to be used toward skill development/upgrading, education, and research. Specifically, the budget aimed to support activities including the following:

- helping offset indirect research costs at universities and research hospitals;

- supporting leading-edge technologies and expanding regional innovation initiatives across the country through increased funding to the National Research Council of Canada;

- providing additional funding to the Natural Sciences and Engineering Research Council and the Social Sciences and Humanities Research Council.10

2001 Budget Plan2001 Budget in Brief

2001 Budget Speech

Part 2: Recovering from the Dot-com bubble (2002-2007)

The federal Canadian budgets falling between 2002 – 2007 bear the mark of the post-2001 Tech Burst/Dot-com bubble.

“The dot-com bubble (also referred to as the Internet bubble and the Information Technology Bubble) was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more recent Internet sector and related fields.11 It reached its peak on March 10, 2000 and a series of closely related events shaped the inevitable decline as many major “dot-coms” became “dot-bombs.”

During this period there was a also a shift towards environmental initiatives. The budgets speak to growing interest in climate change, both as an environmental issue and also as an opportunity for innovative, sustainable technologies.

2002 Federal Budget – MIA

Liberal majority under Prime Minister Jean Chrétien

Despite our best research efforts, the 2002 federal budget seemed to be off floating somewhere in the Internet ether. (We couldn’t even find it using the Wayback Machine.) So, we turned to Library and Archives Canada for assistance.

They told us that the reason there is no 2002 Federal Budget is that in 2001, the Federal Budget was published in December instead of February. A detailed budget update was released before the November 2000 election. There was no need for a new federal budget in February of 2002 since one had just been published a few months before. Instead, a fiscal update was published in October of 2002, followed by the new Federal Budget in February of 2003.

2001 budget update

2002 budget update

2003 Federal Budget

Liberal majority under Prime Minister Jean Chrétien

The 2003 budget took a more aggressive stance with respect to Canadian innovation than in the past. Finance Minister John Manley made a powerful statement, saying that Canada’s

“… economic prosperity, our quality of life and our standard of living require Canada to be a world leader in innovation and learning and to be a magnet for talent and investment–the mark of a ‘Northern Tiger.’12

The budget also reflected growing concerns about environmental issues, while also positioning these issues as an economic opportunity for the development of environmentally-friendly technologies through the following:

- $2 billion toward Climate Change Plan for Canada

- $250 million for Sustainable Development Technology Canada Fund

- $1.7 billion over five years to “support partnership, innovation and targeted measures to promote energy efficiency, renewable energy, sustainable transportation and alternative energy sources.”13

2003 Budget Plan2003 Budget in Brief2003 Budget Speech

2004 Federal Budget

Liberal minority under Prime Minister Paul Martin

As with all previous budgets, the 2004 budget championed education as a bridge that would ultimately lead to innovation and prosperity. The budget was also framed in a simple equation for success that leaned heavily on technological progress: “ingenuity plus technology equals productivity.”

Additionally, the budget called for increased depreciation rates for computers and Internet/broadband technology to “reflect their useful life” as a means of benefiting entrepreneurs and innovators on a wide scale.14

2004 Budget Plan2004 Budget in Brief2004 Budget Speech

2005 Federal Budget

Liberal minority under Prime Minister Paul Martin

Building on the environmental focus of the 2003 federal budget, the 2005 budget also emphasized the “tremendous opportunities” presented by climate change. The budget slated $200 million for a Sustainable Energy Science and Technology Strategy over a span of five years to position Canada as “the birthplace of the next generation of the best ideas and innovation.”

The 2005 budget also outlined the Liberal Party’s past contributions to innovation–$11 billion over the past eight years which “fostered a world-class research environment” and also helped aid commercialization.15

2005 Budget Plan2005 Budget in Brief2005 Budget Speech

2006 Federal Budget

Conservative minority under Prime Minister Stephen Harper

The 2006 budget was exceedingly practical in its focus, as evidenced by its “Focusing on Priorities” tagline. There were no overt references to innovation, the most relevant being reducing business taxes. Instead, the budget was stripped down to five core commitments, including the following:

- Accountability — transparency of framework, limiting growth in spending, and

- Opportunity — reducing GST by 1%, reducing personal/business taxes.16

2006 Budget Plan2006 Budget in Brief2006 Budget Speech

2007 Federal Budget

Conservative minority under Prime Minister Stephen Harper

In the 2007 budget–titled “A Stronger, Safer, Better Canada”–Finance Minister Flaherty spoke about then necessity of restoring fiscal balance, which in turn would allow “Canadians [to] come out ahead through real tax relief:

“$39 billion was promised over a span of seven years to help fund, among other things, better-equipped universities and colleges, job training, and environmental preservation through contributions such as the $1.5 billion promise to create the Canada ecoTrust for Clean Air and Climate Change:17

The Canada ecoTrust for Clean Air and Climate Change will allow each province and territory to develop technology, energy efficiency, and other projects that will provide real results. The Government of Canada will work with all provinces and territories to fully develop this new, national fund. 18

2007 Budget Plan

2007 Budget in Brief

2007 Budget Speech

Part 3: Economic Dip, Nortel, and the NDP Election Sweep (2008-2011)

In order to understand the stance on innovation in federal budgets between 2008 – 2011, it is important to establish the budgets within a larger context. The 2008 – 2011 years featured significant changes in North American business and politics. These changes had a discernible impact on the place of innovation in the Canadian federal budget.

Background

Economic Dip & Nortel

In 2007, the U.S. housing bubble burst. This burst had global repercussions for stock markets, shaking investor confidence. A wave of decline in international trade and increasing credit restrictions followed. The official “end” of the U.S. economic crisis is set somewhere between late-2008 and mid-2009.19 During the later portion of the U.S. economic dip, Northern Telecom Limited (Nortel) was forced into liquidation. Although Nortel is an international telecommunications company, its headquarters are located in Mississauga, Ontario. While the company was technically under bankruptcy protection until mid-April 2012, Nortel had been undergoing a lengthy liquidation process since early 2009:

“On January 14, 2009, Nortel filed for protection from creditors in the United States, Canada, and the United Kingdom, in order to restructure its debt and financial obligations. In June 2009, the company announced it would cease operations and sell off all of its business units. The period of bankruptcy protection has since been extended to April 13, 2012. As part of the bankruptcy proceedings, Nortel Networks Inc. publishes monthly operating reports outlining cash receipts and disbursements.20

2011 NDP Sweep Election

Although Canada’s 2011 federal election was initially criticized as unnecessary by the Conservative government and political pundits alike, it culminated in a surprising sweep by the NDP–103 seats in the House of Commons. This achievement was further bolstered by the Party winning an unprecedented 59 out of 75 seats in Quebec, effectively overpowering the historically Bloc-loyal province.

Despite the fact that Jack Layton was still overshadowed by Stephen Harper’s win, the significance of the NDP sweep in the 2011 Canadian federal election should not be underestimated–especially keeping in mind that Harper and the Conservative government had otherwise ruled without official opposition since 2006. Furthermore, the election also moved the Liberal position from second to third in command, an equally important turn in the Canadian political sphere.21

As a final note on the NDP’s impact, the Party takes a decidedly different stance than the Conservatives when it comes to innovation. The NDPs tend to adopt a “Father Figure” role, favouring direct funding. Alternately, the Conservative Party generally prefers indirect contributions to universities or creates research grants that stimulate innovation through arms’ length funding.

2008 Federal Budget

Conservative minority under Prime Minister Stephen Harper

Echoing the 2006 budget, Minister Flaherty delivered a budget with a similarly practical tagline: “Responsible Leadership.” As with past budgets, 2008 also placed great importance on R&D activities in the form of university research and green technology development. The budget promised $440 million over three years to “secure Canada’s leadership in the global marketplace through research and innovation”, $80 million of that going directly toward research in the following industries: automative, manufacturing, forestry and fishing.

Flaherty praised the auto industry as a “major driver of the Canadian economy.”22 The budget allotted $250 million for an Automotive Innovation Fund that would create jobs through the development of fuel-efficient/greener vehicles. The Minister cited the fund as part of the government investment promised in the 2007 Science and Technology Strategy.

2008 Budget Plan

2008 Budget in Brief

2008 Budget Speech

2009 Federal Budget

Conservative minority under Prime Minister Stephen Harper

The 2009 budget picked up on the previous year’s emphasis on green technology development and the necessity of targeted support for key industries. Flaherty referenced both Canada’s commitment to the G20 leaders’ summit and the global economic crisis as motivations for investing in “foundations of long-term economic growth.”

To aid in this long-term growth, the budget called for Immediate Action to Build Infrastructure, an investment of nearly $12 billion dollars to create a modern, greener infrastructure for Canada. The funding for this “immediate action” was outlined as follows:

- $750 million to the Canada Foundation for Innovation to support leading-edge research infrastructure.

- $50 million to the Waterloo University Institute for Quantum Computing for a new research facility.

- $1 billion for clean energy research, development and demonstration projects.

- $110 million over three years for space robotics research and development. 23

Additionally, the budget slated $7.5 million for “targeted support for the auto, forestry and manufacturing sectors, as well as funding for clean energy.

2009 Budget Plan

2009 Budget in Brief

2009 Budget Speech

2010 Federal Budget

Conservative minority under Prime Minister Stephen Harper

The aim of the 2010 budget was to sustain the momentum of previous years by expanding the breadth of government-supported research. The budget featured a laundry list of activities, institutes and research councils that would receive funding from federal research grants. Included on this list were the following:

- $13 million per year to the Natural Sciences and Engineering Research Council, including $8 million per year to strengthen its support for advanced research, and $5 million per year to foster closer research collaborations between academic institutions and the private sector through its Strategy for Partnerships and Innovation;

- $15 million per year to the College and Community Innovation Program to support additional research collaborations between businesses and colleges;

- $222 million over five years to support research and commercialization activities at TRIUMF, Canada’s premier national laboratory for nuclear and particle physics research;

- $75 million in 2009–10 to Genome Canada to allow it to launch a new targeted research competition in a priority area and sustain funding for the regional genomics innovation centres, and more.24

Finally, the budget also indicated that the government would make a concerted effort to review federal support for R&D in order to “improve its contribution to innovation and economic opportunities for business”, saying that these reviews would factor into future budgetary decisions.

2011 Federal Budget

Conservative majority under Prime Minister Stephen Harper

Delivered on June 6, 2011, the federal budget featured 4 main pillars for innovation, stressing the importance of education and research. As in 2010, the budget targeted extremely specific institutions, research facilities, etc. rather than referring to broad industries such as environmentally-friendly technology or the automotive industry. The 4 pillars are as follows:

1. Investing in innovation, education and training — Supporting SMEs through the Industrial Research Assistance Program to create collaborative projects with colleges that would “accelerate their adoption of key information and communications technologies”; increasing federal granting council contributions; expanding Canada Student Loan eligibility; funding for international studies, including tax relief for students studying abroad and $10 million to develop/implement an international education strategy to draw international students to Canada, etc.

2. Driving Innovation: Canada’s Digital Economy Strategy — Making Canada a “leader in the creation, adoption and use of digital technologies and content”;25 $60 million over three years to support student enrolment in targeted digital disciplines; $100 million/year to the Canada Media Fund.

3. Strengthening Canada’s research advantage — “New resources to support leading-edge research, international collaborations, health research of national importance, and the creation of world-class research centres in Canada.” This support would include $53.5 million over five years to be used toward creating 10 new Canada Excellence Research Chairs; up to $100 million to aid in establishing the Canada Brain Research Fund; an additional $65 million for Genome Canada, amongst others.

4. Fostering commercialization and business innovation — These funds included support for marketplace demonstrations of new technologies, including those of Sustainable Development Technology Canada and the National Optics Institute.

2011 Budget Plan

2011 Budget in Brief

Budget Speech

2011 Budget Plan (2nd ed.)

2011 Budget in Brief (2nd. ed)

2011 Budget Speech (2nd ed.)

Part 4: Reducing costs, overhauling SR&ED (2012-2015)

Background

In the time leading up to this budget, there had been calls to improve the SR&ED program. The introduction of the “short form” T661 (limiting the length of the submission) had resulted in an increase in reviews, delays, and general discontent. There were a series of scathing news articles that prompted several reports. Multiple changes were implemented during this period.

2012 Federal Budget

Conservative majority under Prime Minister Stephen Harper

If you’re adventurous, you can download your own copy of the 498-page manuscript here (PDF).

General Changes Based on Jenkins Report

- Double the contribution budget of the Industrial Research Assistance Program to better support research and development by small and medium-sized companies.

- Support private and public research collaboration through internships for graduate students and funding for business-led research and development.

- Support innovation through procurement by connecting small and medium-sized companies with federal departments and agencies to build their capacity to compete in the marketplace.

- Refocus the National Research Council on demand-driven business-oriented research that will help Canadian businesses develop innovative products and services.

- Help high-growth firms access risk capital by committing significant funds to lever increased private sector investments in early-stage risk capital and to support the creation of large-scale venture capital funds led by the private sector.

- Streamline and improve the SR&ED tax incentive program by removing capital from the expenditure base, making it more cost-effective through design improvements and a measured rate reduction, and providing greater predictability through administrative improvements.

Federal Changes to the SR&ED Program

- The rules regarding the eligibility of capital expenditures are the most complex for businesses to comply with. In order to simplify the program, Economic Action Plan 2012 proposes to narrow the base of eligible expenditures by removing capital. The other expenditure elements will remain eligible, including salary and wages, materials, overhead expenses and contract payments. This proposed change will affect capital expenditures incurred in 2014 and subsequent years.

- To limit instances where the rules result in tax credits being provided for overhead costs that exceed the actual costs incurred, Economic Action Plan 2012 proposes to gradually reduce the “prescribed proxy amount” that is used to compute overhead expenditures under the so-called “proxy method,” from 65 per cent to 55 per cent of direct labour costs. The 55-per-cent rate will be fully phased in as of January 1, 2014.

- To remove the profit element from arm’s length contract payments, Economic Action Plan 2012 proposes to allow only 80 per cent of these contract payments to be used for the purposes of calculating the SR&ED tax credits. This change is consistent with the current tax treatment of non-arm’s length contracts, and will target the tax credits to SR&ED expenditures incurred, and not on profit margins. It will be effective as of January 1, 2013.

- Economic Action Plan 2012 also proposes a reduction in the general SR&ED investment tax credit rate. The recent corporate income tax rate reductions (from 22.12 per cent in 2007 to 15 per cent in 2012) have effectively increased the relative generosity of the SR&ED tax incentive program and resulted in growing pools of unused investment tax credits. Effective January 1, 2014, the general SR&ED investment tax credit rate will be reduced from 20 per cent to 15 per cent.

Changes to the CRA Review Structure

Based on the then-recently released Ombudsman report and Jenkins report, the government refined the CRA review process:

The Canada Revenue Agency (CRA) has recently implemented a number of administrative improvements to address challenges that have been identified by stakeholders in the areas of accessibility, predictability, and consistency. These improvements include:

- Increasing the number of technical reviewers.

- Providing additional training and establishing coordinated technical support for the technical reviewers

- Devoting more time to program services.

- Enhancing the quality assurance methodology

- Reviewing dispute resolution procedures to ensure their effectiveness.

In addition, the CRA is in the process of consolidating and clarifying the administrative policies that are currently contained in about 70 documents pertaining to the SR&ED tax incentive program. The revised information will ultimately be presented in a user-friendly format on the CRA website in December 2012, with the objective of reducing complexity and improving accessibility.

Summary of Changes

The changes proposed by the government will be phased into the system over the next few years. It will be conducted as follows: January 1, 2013: Contract Payments reduced to 80% of the paid value. January 1, 2014: Proxy overhead calculations reduced to 55% from 65%. January 1, 2014: General SR&ED refundable credit reduced to 15% from 20%. 2014: All capital expenditures incurred during the 2014 fiscal period will not be eligible for SR&ED.

2012 Budget Plan

2012 Budget in Brief

2012 Budget Speech

2013 Federal Budget

Conservative majority under Prime Minister Stephen Harper

Canada Revenue Agency Delivers on the Needs of Small Businesses

The CRA is undertaking several initiatives to reduce the tax compliance burden associated with the Scientific Research and Experimental Development (SR&ED) tax incentive program. In particular, a pilot project to determine the feasibility of a Formal Pre-Approval Process for SR&ED claims was just launched. This pilot project will provide valuable information on whether a Formal Pre-Approval Process service would be an effective way to provide greater certainty to claimants on the eligibility of their research and development expenditures for SR&ED tax incentives. (P. 126)

Strengthening the Impact of the Scientific Research and Experimental Development Tax Incentive Program

The Scientific Research and Experimental Development (SR&ED) tax incentive program is one of the most generous systems in the industrialized world for research and development (R&D). It is the single largest federal program supporting business R&D in Canada, providing more than $3.6 billion in tax assistance in 2012.

In Economic Action Plan 2012, the Government noted its concern that high contingency fees charged by SR&ED tax preparers reduce the effectiveness of the SR&ED tax incentive program. The Government announced that it would consult on contingency fees charged by SR&ED tax preparers to find out whether these fees diminish the benefits of the SR&ED program to Canadian businesses and the economy. To that end, a discussion paper was released inviting submissions, and consultations were undertaken in 2012.

The submissions received by the Government during the consultations indicated that intervention to regulate contingency fees directly is not required: the market for SR&ED tax preparers is competitive, contingency fee rates have declined over time and there is no evidence that this type of billing arrangement results in higher compliance costs for businesses.

Instead, many stakeholders recommended that the Government enhance the predictability of the SR&ED tax incentive program, and take action to address aggressive positions being taken by some tax preparers and claimants. In line with that feedback, Economic Action Plan 2013 proposes a number of measures:

- New funding of $5 million over two years will be provided to the Canada Revenue Agency to conduct more direct outreach with first-time SR&ED program claimants. A new in-person service will be implemented to ensure that new claimants have access to information about the SR&ED program’s eligibility requirements, the required supporting documentation, and any other information needed to facilitate the filing of their SR&ED program claim. This new in-person service will help new claimants to better understand the SR&ED program parameters, and contribute to reducing taxpayers’ reliance on third-party tax preparers. The Canada Revenue Agency will also develop new web-based seminars that will be available to the SR&ED community at no cost.

- The Canada Revenue Agency will also receive new funding of $15 million over two years to focus more resources on reviews of SR&ED program claims where the risk of non-compliance is perceived to be high and eligibility for the SR&ED program unlikely. The Canada Revenue Agency will also more frequently apply penalties for false statements or omissions, where appropriate. In addition, in order to enable better risk assessment, SR&ED program claim forms will be revised to require more detailed information. To enforce this new requirement, Economic Action Plan 2013 proposes that a new penalty be applied in instances where the new required information is missing, incomplete or inaccurate.

These new initiatives will help protect the integrity of the SR&ED tax incentive program. (P.201-203)

A Summary of Updates to SR&ED

2014 Federal Budget

Conservative majority under Prime Minister Stephen Harper

The only mention of the SR&ED program in the 2014 budget appears in Table A2.2 ‘Integrity and Fairness Tax Measures since Budget 2010‘, which is buried in the Appendix on page 382. This is a huge contrast compared to previous years; the CRA had announced several new changes to the program building on what was announced in the 2013 budget, but no legislative changes were proposed for the 2014 fiscal year.

2014 Budget Plan

2014 Budget in Brief

2014 Budget Speech

2015 Federal Budget

Conservative majority under Prime Minister Stephen Harper

2015 was, like 2014, a quiet year for SR&ED in the budget. Although a significant portion of the budget was associated with innovation, with the government outlining a number of new direct funding programs, the budget elected not to bring up the SR&ED program.

While the SR&ED program was conspicuously absent, the government touted massive spending on direct funding programs. A selected list follows:

- Providing an additional $1.33 billion over six years, starting in 2017–18, to the Canada Foundation for Innovation to support advanced research infrastructure at universities, colleges and research hospitals.

- Creating a more efficient and effective national digital research infrastructure system by providing $105 million over five years, starting in 2015–16, to CANARIE, Canada’s world-class high-speed research and education network.

- Dedicating $119.2 million over two years, starting in 2015–16, to the National Research Council’s industry-partnered research and development activities, helping Canadian businesses increase their competitiveness and develop new, cutting-edge products.

- Helping to develop the next generation of research and development leaders by providing $56.4 million over four years, starting in 2016–17, to Mitacs in support of graduate-level industrial research and development internships.26

Part 5: New Government, New Innovation Agenda (2016-present)

Background

After a dramatic federal election, the Liberal party won a surprise majority, taking 184 of the 338 seats in parliament with representatives in every province and roughly 40% of the popular vote. With the new leadership came a clear attempt to “take the reigns” in regards to innovation.

2016 Federal Budget

Liberal Majority under Prime Minister Justin Trudeau

Innovation Funding in the Budget: An Overview

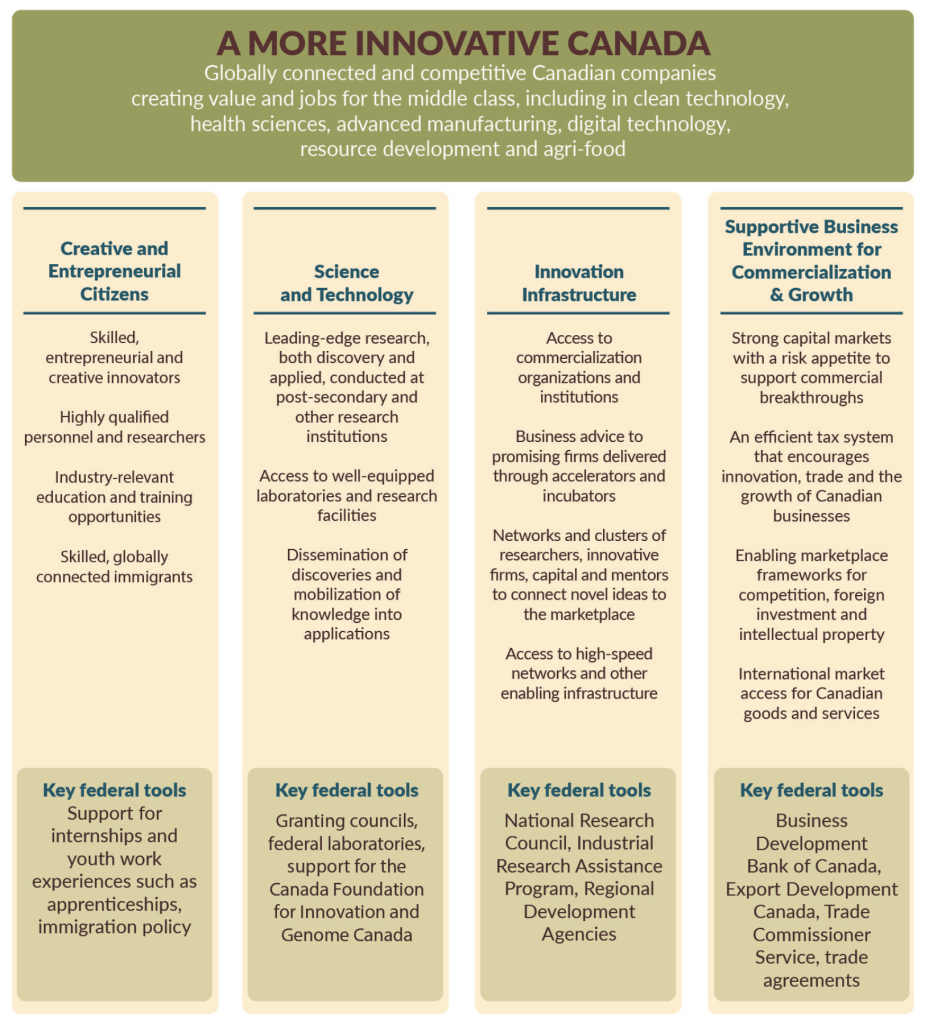

In his budget speech, Finance Minister Bill Morneau stated that support for innovative sectors would help to “ensure Canada is at the forefront of technological advancement in the 21st century.”27 Budget 2016 promises to make this goal a reality by offering support for innovative research and post-secondary institutions, expanding access to business development services, creating so-called “innovation hubs”, and encouraging commercialization in innovative sectors.

A More Innovative Canada” from federal budget 2016 28

Highlight’s from the budget’s innovation funding initiatives include:

- $2 billion over three years for targeted, short-term infrastructure projects under the Post-Secondary Institutions Strategic Investment Fund, to be used for “enhancing and modernizing research and commercialization facilities on Canadian campuses, as well as industry-relevant training facilities at college and polytechnic institutions, and projects that reduce greenhouse gas emissions”;

- $95 million per year in new annual funding for “discovery research”, including $30 million for the Natural Sciences and Engineering Research Council (NSERC);

- $41.5 million to support the “rehabilitation and modernization of select Agriculture and Agri-Food Canada and Canadian Food Inspection Agency research stations and laboratories” in select provinces;

- Up to $800 million to support creation of innovation networks and clusters; and

- An additional $50 million in 2016-17 to increase services offered by the National Research Council’s Industrial Research Assistance Program (IRAP)29

However, you may notice that these “highlights” do not include any mention of the Scientific Research and Experimental Development (SR&ED) program. Why is this?

No Mention of the SR&ED Program

As anticipated by a number of analysts and journalists, the 2016 budget appears to continue the previously identified trend in federal innovation funding — a shift away from indirect funding and towards direct funding. Although the budget cites specific funding allocations for direct funding programs like IRAP, there are little to no mentions of indirect funding programs.

In fact, there are absolutely no mentions of the Scientific Research and Experimental Development (SR&ED) program, arguably the best example of indirect R&D funding in Canada.

Government-Guided Innovation

As noted in our pre-budget predictions article, indirect funding gives companies greater leeway to choose their topics of research, whereas direct funding tends to guide innovative sectors towards particular topics of research.

This inclination is supported by the budget and its supporting documents, which list a number of specific areas of activity and research. These initiatives and activities include genomics, so-called “world-class health discoveries”, stem cell research, the International Space Station, agriculture and agri-food, clean technology and digital technology, natural resource development, and more. 30. The budget allocates $237.2 million to Genome Canada alone.31

Introduction of the Vague “Innovation Agenda”

The 2016 budget states that the government is “defining a new vision for Canada’s economy: to build Canada as a centre of global innovation.“32

Although it is only vaguely defined in the budget, the so-called “Innovation Agenda” will be developed throughout 2016-17 to achieve a number of goals through “alignment, coordination and simplification”

The government will redesign and redefine how it supports innovation and growth, in partnership and coordination with the private sector, provinces, territories and municipalities, universities and colleges, and the not- for-profit sector.

The Innovation Agenda will define clear outcomes—objectives and metrics to measure progress towards this vision.33

Supporting Innovative “Clusters”

Finance Minister Bill Morneau’s budget speech made several mentions of the importance of “clusters” in supporting innovative sectors, with specific mention to one of Canada’s hotbeds of innovative activity (emphasis added):

“Everyone knows Silicon Valley is the world’s capital of digital technology. But, I’ll tell you, everyone in Silicon Valley knows that Canada’s own Waterloo region is home to some of the most brilliant, innovative minds and companies in the world.34

To this end, the budget also introduced the development of a nation-wide, online “Canadian Cluster Mapping” portal that would map the “composition of regional economic performance and patterns of business relationships” to help guide funding programs at all levels of government. 35

2017 Federal Budget

Liberal Majority under Prime Minister Justin Trudeau

On March 22, 2017, federal Finance Minister Bill Morneau introduced the Liberal Party’s much-anticipated 2017 federal budget, titled “Building a Strong Middle Class”. This was the Liberal Party’s second budget since their election to office in October 2015. In it, the government announced that their focus was partially on the “new, more innovative economy of tomorrow.” This focus is based on recommendations made on February 6, 2017, by the Minister’s Advisory Council on Economic Growth who had just released a report titled “Unlocking Innovation to Drive Scale and Growth”.

SR&ED in the Budget: An Overview

Budget 2017 promised to make several changes to SR&ED, to ensure “its continued effectiveness and efficiency.” The current plan is to initiate a “whole-of-government review of business innovation programs.” In the main budget document, the following appears:

Initiate a whole-of-government review of business innovation programs. To ensure that its programs are simple and effective and best meet the needs of Canada’s innovators, the Government will review existing programs with the help of external experts. The review will encompass all relevant federal organizations, including Innovation, Science and Economic Development Canada, Natural Resources Canada, and Agriculture and Agri-Food Canada. In parallel, the Government will also review the Scientific Research and Experimental Development tax incentive program to ensure its continued effectiveness and efficiency.

In time, Innovation Canada will serve as a one-stop-shop for Canada’s innovators. Canadian innovators and entrepreneurs will no longer need to spend time figuring out which department to go to or which program best meets their needs. Innovation Canada will host the federal government’s simplified suite of innovation programs that will better enable and support Canadian innovators.36

The only other reference to SR&ED is a brief bullet point under “Closing Tax Loopholes”:

Clarify the intended meaning of “factual control” under the Income Tax Act for the purpose of determining who has control of a corporation in order to prevent inappropriate access to supports such as the small business tax rate and the enhanced refundable 35-per-cent Scientific Research and Experimental Development Tax Credit for small businesses.37

A more detailed explanation appears in the Tax Measures: Supplementary Information document:

MEANING OF FACTUAL CONTROL

The Income Tax Act recognizes two forms of control of a corporation: de jure (legal) control and de facto (factual) control. The concept of factual control is broader than legal control and is generally used to ensure that certain corporate tax preferences are not accessed inappropriately.

For example, the factual control test is used for the purpose of determining whether two or more Canadian controlled private corporations are “associated corporations”. Associated corporations must be considered together in determining whether certain thresholds are met, such as the $500,000 small business deduction limit and the limit on qualifying expenditures relating to the refundable 35-per-cent scientific research and experimental development tax credit. A person may have factual control of a corporation even though the person does not have legal control of the corporation.

Legal control of a corporation generally entails the right to elect the majority of the board of directors of the corporation. Factual control of a corporation exists where a person has “directly or indirectly in any manner whatever” influence that, if exercised, would result in control in fact of the corporation. In each situation, consideration of all the relevant factors is required in determining whether there is factual control of a corporation. A significant body of case law has developed concerning which factors may be useful in determining whether factual control exists.

A recent court decision held that, in order for a factor to be considered in determining whether factual control exists, it must include “a legally enforceable right and ability to effect a change to the board of directors or its powers, or to exercise influence over the shareholder or shareholders who have that right and ability”. This requirement limits the scope of factors that may be taken into consideration in determining whether factual control of a corporation exists. It is not intended from a policy perspective that the factual control test be dependent on the existence of such a legally enforceable right, or that factors that do not include such a right ought to be disregarded.

To ensure taxpayers do not inappropriately access certain tax preferences, Budget 2017 proposes that the Income Tax Act be amended to clarify that, in determining whether factual control of a corporation exists, factors may be considered that are not limited to the requirement set out above.

This measure will apply in respect of taxation years that begin on or after Budget Day.38

2017 Budget Plan

2017 Budget in Brief

2017 Budget Speech

2018 Federal Budget

Liberal Majority under Prime Minister Justin Trudeau

On February 27, 2018, federal Finance Minister Bill Morneau tabled the Liberal Party’s 2018 federal budget, titled “Equality + Growth A Strong Middle Class”. This was the Liberal Party’s third budget since their election to office in October 2015. In it, the government affirmed their “people-centred approach.” This was guided by the Gender Results Framework to ensure all Canadians have an equal opportunity for success.39

There were five main areas of focus in this budget – Growth, Progress, Reconciliation, Advancement, and Equality. Support for Canadian academic research and business innovation appeared under the Progress heading. The budget proposed investing nearly $4 billion into Canada’s research system to support researchers and $2.6 billion in incremental support over five years to streamline existing innovation programs to enable Canadian businesses to reach and compete in the global marketplace.40

SR&ED in the Budget

SR&ED was not specifically mentioned in the 2018 budget document. However, there were several new initiatives announced aimed at supporting innovation and business in Canada. The government announced four flagship platforms to streamline user experience and to encourage increased participation from the research and business community.

“The Government currently supports businesses of all types and sizes through a vast and complicated array of programming. As recommended by the Advisory Council on Economic Growth, Budget 2017’s Innovation and Skills Plan announced a review of all innovation programs that serve the business community, in an effort to make the services provided more responsive to client needs, more efficient and better able to promote business growth.” 41

The Industrial Research Assistance Program was developed to support Canadian entrepreneurs and small business owners as they move towards entering the global marketplace.

The Strategic Innovation Fund provides increased support for larger, more job-centric projects with greater impact for a larger number of Canadians.

The Canadian Trade Commissioner Service (TCS) aims to increase Canadian exports by again, streamlining the service process and the client experience.

Finally, the government has announced increased budgetary support for Regional development agencies that serve to support “regional innovation ecosystems.” 42

2018 Budget Plan

2018 Budget Speech

2019 Federal Budget

Liberal Majority under Prime Minister Justin Trudeau

On March 19, 2019, federal Finance Minister Bill Morneau tabled the Liberal Party’s 2019 federal budget, titled Investing in the Middle Class. Interestingly the budget was published prior to Minister Morneau’s speech. As this is an election year there are very few surprises in the budget, the focus remains a continuation of the previous year’s themes; building a better middle class, a stronger country, reconciliation, supporting change and gender equality.

A Surprising – and Significant – Change in 2019

A significant announcement has been made in relation to SR&ED: repealing the use of taxable income as a factor in determining a CCPC’s annual expenditure limit for the purpose of the enhanced SR&ED tax credit. As a result, small CCPCs with taxable capital of up to $10 million will benefit from unreduced access to the enhanced refundable SR&ED credit regardless of their taxable income.

Scientific Research and Experimental Development Program

Under the Scientific Research and Experimental Development (SR&ED) tax incentive program, qualifying expenditures are fully deductible in the year they are incurred. In addition, these expenditures are eligible for an investment tax credit. The rate and level of refundability of the credit vary depending on the characteristics of the firm, including its legal status and its size 43.

- For all corporations other than Canadian-controlled private corporations (CCPCs) and for unincorporated businesses, a 15-per-cent non-refundable tax credit is available on all qualifying SR&ED expenditures.

- For CCPCs, a fully refundable enhanced tax credit at a rate of 35 per cent is available on up to $3 million of qualifying SR&ED expenditures annually. This expenditure limit for a taxation year is gradually phased out based on two factors, which apply on the basis of an associated group.

- The expenditure limit is reduced where taxable income for the previous taxation year is between $500,000 and $800,000.

- The expenditure limit is also reduced where taxable capital employed in Canada for the previous taxation year is between $10 million and $50 million.

- Qualifying expenditures in excess of a CCPC’s expenditure limit are eligible for the 15-per-cent tax credit. Unused SR&ED credits earned at this rate may be partially refundable depending on the CCPC’s taxable income and taxable capital.

Table 5 presents the amount of SR&ED credits on $3 million of SR&ED expenditures at specific levels of taxable capital and taxable income under the current rules. In particular, it illustrates how these credits can be affected by a relatively small change in the amount of taxable income for firms within the phase-out range.

For example, a CCPC that spends $3 million on qualifying SR&ED expenditures in a taxation year, and that has $500,000 of taxable income and $10 million of taxable capital in the previous taxation year, is eligible for the 35-per-cent refundable SR&ED credit on all of its expenditures, resulting in a fully refundable credit of $1.05 million. If the corporation’s taxable income for the previous taxation year were $600,000 instead, the total SR&ED tax credits earned would have been $850,000 (of which $700,000 would have been refundable). For this CCPC, a $100,000 increase in taxable income would have resulted in a $200,000 reduction in SR&ED tax credits.

Budget 2019 proposes to repeal the use of taxable income as a factor in determining a CCPC’s annual expenditure limit for the purpose of the enhanced SR&ED tax credit. As a result, small CCPCs with taxable capital of up to $10 million will benefit from unreduced access to the enhanced refundable SR&ED credit regardless of their taxable income. As a CCPC’s taxable capital begins to exceed $10 million, this access will gradually be reduced as shown in the highlighted column in Table 5.

This change will provide a more predictable phase-out of the enhanced SR&ED credit rate, which will more effectively support growing small and medium-sized firms as they scale up.

This measure will apply to taxation years that end on or after Budget Day 44.

This change comes as a surprise – in the last decade, the changes have focused on reducing the amount disbursed via the SR&ED program. For more details, please review our summaries of previous federal budgets.

The government reasoning for the changes is as follows:

Improving Support for Small, Growing Companies

The Scientific Research and Experimental Development (SR&ED) Tax Incentive Program encourages business innovation by providing an investment tax credit for businesses of all sizes, in all sectors, that conduct scientific research and experimental development in Canada. In a global economy where knowledge and ideas are key, the innovation of Canadian firms will be a competitive advantage. The SR&ED Tax Incentive Program is often cited as a significant source of support by Canada’s innovative firms, as it provides a 35-per-cent refundable tax credit to eligible small and medium-sized businesses and a 15-per-cent tax credit to all businesses performing SR&ED in Canada. Access to the 35-per-cent rate is determined by a business’ level of income and capital.

One challenge often cited by entrepreneurs who use the SR&ED program to grow their firm relates to how the incentive changes based on the growth of their business.

To better support growing innovative businesses as they are scaling up, the Government proposes to eliminate the income threshold for accessing the enhanced credit. This will ensure continued enhanced support for small and medium-sized innovative businesses that are experiencing rapid growth in income or may have variable income from year to year; that is, at the exact time when continued Government support can help take a business to the next level. The capital threshold will continue to apply to ensure that the enhanced rate remains targeted toward small and medium-sized businesses. This change will build on other major initiatives put forward by the Government to help make Canada a leader in science and innovation, creating the jobs of tomorrow and building globally leading businesses 45.

What is the impact?

This is perhaps one of the most expensive proposed changes in the budget over the projected 5-year period. It is estimated that it will increase government spending by $395 million, which is only dwarfed by the Canada Training Tax Credit ($815 million).

Table 1 – Federal Budget 2019

What Does This Mean?

This will result in a sudden increase of SR&ED funding being provided at the federal level and a more predictable phase-out of the enhanced SR&ED credit rate, which will be of great benefit for some organizations; however, the changes do not address the systemic issues associated with submitting SR&ED applications and the complexity of the associated reviews, which can be both time-consuming and frustrating. Further, the increased tax incentive may mean more disputes that reach the Tax Court of Canada. Ultimately, while well-intended, this change may put the program at risk of total elimination in future periods if the next government wants to cut costs.

The SR&ED program is one of many important tools in the innovation toolbox and must be wielded wisely. Thus, it now is up to the CRA to ensure that the interpretation of the policies and administration of the tax credit reflect the positive outlook of the budget, which seeks to support R&D in Canada.